AMC stock has been a hot topic on Reddit forums lately. The online community has played a significant role in driving the stock’s price movement. Redditors have collectively discussed and shared their thoughts, analysis, and investment strategies related to AMC stock. This grassroots movement has attracted a massive number of retail investors, resulting in significant volatility in the stock price. The power of social media and online forums like Reddit cannot be underestimated, as they have the potential to influence market trends and disrupt traditional stock trading strategies.

Mục lục

Overview of AMC Stock’s recent surge

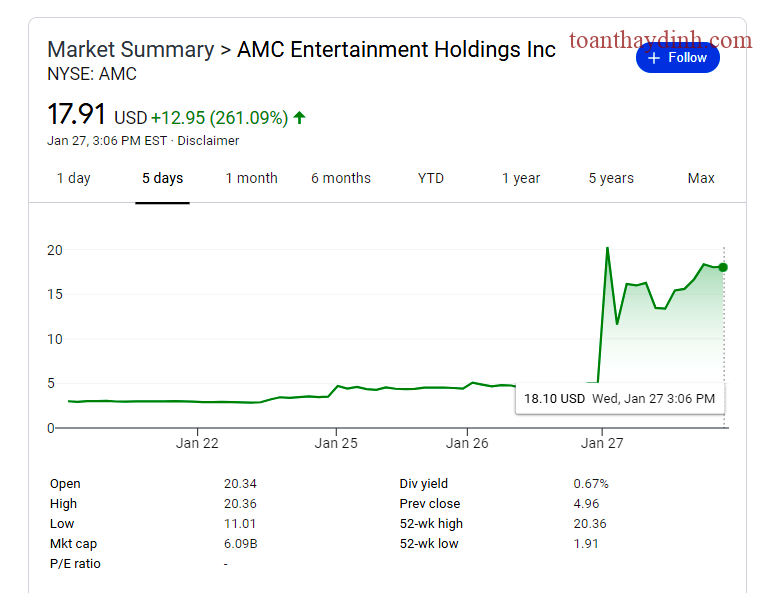

The recent surge in AMC stock has taken the financial world by storm. AMC Entertainment Holdings, Inc., the renowned American movie theater chain, saw its share prices skyrocket in a phenomenon that attracted widespread attention. Investors and market experts have been trying to decipher the reasons behind the unprecedented surge in AMC stock.

The surge began in early 2021 when AMC stock experienced a significant increase in value. This surge was especially remarkable considering the turbulent times faced by the entertainment industry during the COVID-19 pandemic. With movie theaters shutting down and the uncertainty surrounding the future of the cinema business, the sudden surge in AMC stock came as a surprise to many.

One possible explanation for the surge lies in the role of retail investors and online communities, particularly the influential subreddit forum called WallStreetBets. This forum on Reddit became a breeding ground for discussions, analysis, and speculative trading ideas. The individual investors participating in these forums were able to rally together and create massive momentum in the market. The surge in AMC stock is a testament to the growing power of retail investors and the impact of social media platforms on stock trading.

However, it is important to note that the surge in AMC stock is not solely driven by the Reddit community. Various factors contribute to the stock’s performance, including overall market conditions, investor sentiment, and company-specific developments. The Reddit community’s role in driving the surge should be seen as a part of the broader picture.

The Reddit community, especially the subreddit WallStreetBets, played a crucial role in amplifying the surge in AMC stock. The forum acted as a gathering place for individual investors, known as retail investors, who were looking for unique investment opportunities outside of traditional norms. These investors often demonstrated an appetite for risk and were willing to challenge the established financial institutions.

Through WallStreetBets, retail investors found a collective voice and a platform to share their investment ideas. The power of this forum lies in its ability to create a strong sense of community and solidarity among its members. Retail investors were able to discuss and analyze potential investment opportunities, including AMC stock.

The surge in AMC stock gained momentum as retail investors began buying shares and spreading the word about their investment on social media platforms such as Twitter, Facebook, and TikTok. Many users even took to YouTube and other video-sharing platforms to share their bullish sentiments about AMC stock, causing a ripple effect and drawing more attention to the security.

The Reddit community’s influence extended beyond social media platforms. Retail investors actively encouraged each other to hold their AMC stock investments rather than selling, which further fueled the stock’s surge. This phenomenon, known as a “diamond hands” mentality, was an attempt to challenge conventional market dynamics and squeeze short-sellers who had taken positions against the stock.

It is worth noting that the surge in AMC stock driven by the Reddit community generated significant media coverage and scrutiny. Critics argue that this phenomenon exemplifies the dangers of unregulated retail trading and market manipulation. However, supporters argue that it demonstrates the power of the individual investor and the potential democratization of the stock market.

In conclusion, the surge in AMC stock witnessed in recent times can be attributed in part to the role played by the Reddit community, particularly the subreddit WallStreetBets. The collective power of retail investors, amplified by social media platforms, has challenged traditional market dynamics and drawn attention to unconventional investment opportunities. While the role of the Reddit community should not be overstated, its impact on AMC stock highlights the changing nature of stock investing and the influence of online communities.

The surge in AMC stock reddit is a prime example of how social media platforms and retail investors can come together to create significant market disruptions, capturing the attention of both the financial industry and the general public.

The Rise of Reddit’s Influence

Reddit has rapidly emerged as a powerful platform that fosters online communities and facilitates discussions on a myriad of topics. One particularly noteworthy aspect of Reddit’s influence is its impact on the world of finance and investing. In recent years, Reddit has played a pivotal role in shaping the dynamics of the financial markets through the emergence of online investment communities.

Emergence of online investment communities

The rise of online investment communities on Reddit has democratized the investment landscape, allowing individuals from all walks of life to come together and share their insights, strategies, and experiences in the financial markets. These communities have created an environment where retail investors can collaborate and collectively amplify their influence in the market.

One of the most notable examples of the power of online investment communities on Reddit is the phenomenon surrounding the “amc stock reddit” – the community of investors who discuss and analyze the AMC stock on the platform. The AMC stock, along with other stocks such as GameStop (GME), has gained significant attention due to the collective actions and discussions on Reddit.

These online investment communities on Reddit have democratized access to information and analysis, leveling the playing field for retail investors who previously may have been overshadowed by institutional investors. The power of these communities lies in their ability to generate and disseminate information quickly and efficiently, leading to swift market movements.

Power of collective action and retail investors

Reddit’s influence extends beyond just discussions and analysis. It has become a catalyst for collective action among retail investors, empowering them to challenge the status quo of the financial markets. Through coordinated efforts on Reddit, retail investors have been able to challenge short-selling strategies employed by hedge funds, leading to significant disruptions in the market.

The “amc stock reddit” community, along with others, has exemplified the power of collective action. By leveraging their combined influence, these retail investors have managed to sway market sentiments, causing stock prices to skyrocket and forcing institutional investors to reconsider their positions. This unprecedented power has caught the attention of the financial world and has sparked debates about the need for regulatory interventions to ensure market stability.

However, it’s important to note that the influence of Reddit’s investment communities is a double-edged sword. While collective action can lead to positive outcomes for retail investors, it can also contribute to market volatility and create risks for those who may blindly follow the crowd without conducting thorough due diligence.

In conclusion, Reddit’s influence in the financial markets, driven by the rise of online investment communities, has revolutionized the way retail investors participate in and impact the market. The “amc stock reddit” community serves as a prime example of how these communities can come together, analyze opportunities, and collectively influence market dynamics. However, it is crucial for individuals to approach investment decisions with caution and conduct thorough research to mitigate potential risks associated with this newfound influence.

Anatomy of AMC’s Surge

Stock’s initial undervaluation and short interest

One of the key factors behind the surge in AMC’s stock price was its initial undervaluation and high short interest. In early 2021, AMC Entertainment Holdings, the world’s largest movie theater chain, faced significant challenges due to the global pandemic. With movie theaters shutting down and the uncertainty surrounding the future of the film industry, many investors believed that AMC was overvalued and had a bleak outlook. This led to a high short interest in the stock, with hedge funds and other institutional investors betting against the company’s success.

However, as the global economy started recovering and vaccination rates increased, the sentiment around AMC began to shift. Investors realized that the initial pessimism had undervalued the company’s potential for recovery, considering its strong brand presence and loyal customer base. As the prospects for the entertainment industry improved, more traders started to buy AMC shares, leading to increased demand and a surge in its stock price.

Reddit’s targeted buying strategy

Another crucial factor contributing to AMC’s surge was the targeted buying strategy employed by users of the popular online community, Reddit. Specifically, the subreddit known as WallStreetBets played a significant role in driving up the stock price. The members of this community, consisting of individual retail investors, coordinated their efforts to buy AMC shares and hold them, collectively driving up the demand and price.

The motivation behind this movement was not solely financial. Many members of WallStreetBets aimed to expose what they perceived as manipulation by large hedge funds that had heavily shorted AMC’s stock. By banding together and purchasing AMC shares, these individual investors hoped to squeeze the short-sellers and potentially drive the stock price even higher.

This organized buying strategy gained significant media attention, attracting not only retail investors but also a broader audience interested in the dynamics of the stock market. It led to a social media frenzy and amplified the impact of individual investors on traditionally institutional-driven markets. As a result, AMC’s stock price skyrocketed, surpassing even the most optimistic expectations.

The social media frenzy surrounding AMC stock had a profound impact on its price. The combination of retail investors coordinated through Reddit and the attention generated on various social media platforms created a feedback loop that propelled the stock to unprecedented levels.

As news spread about the coordinated buying strategy and the potential for profits, more and more retail investors flocked to join the movement. This influx of new buyers further increased demand and pushed AMC’s stock price higher. The rapid rise in value attracted mainstream media coverage and fueled even greater interest.

It’s important to note that this social media frenzy also attracted skeptics who questioned the sustainability of the surge and warned of potential risks. While some individuals made substantial profits from the surge, others experienced significant losses when the stock price later declined.

In conclusion, AMC’s surge was the result of multiple factors, including the initial undervaluation and high short interest in the stock, as well as the coordinated buying strategy orchestrated by Reddit’s WallStreetBets community. The social media frenzy that followed further amplified the impact, ultimately leading to a significant increase in AMC’s stock price. The unprecedented attention generated by this event caused a fundamental shift in the way the stock market is perceived and demonstrated the power of individual investors united through online platforms. The saga of AMC stock and its connection to Reddit will likely be remembered as a defining moment in the evolution of financial markets.

Wall Street vs Institutions caught off guard

The recent GameStop and AMC stock events have sent shockwaves through Wall Street, catching many institutional investors off guard. These investors, who are typically well-funded and have significant resources at their disposal, found themselves on the losing end as a group of retail investors collaborated on social media platforms like Reddit to drive up the prices of these struggling companies. The surge in stock prices led to massive losses for the institutions, who were forced to cover their short positions at much higher prices.

One of the reasons why institutions were caught off guard is because they underestimated the power of the retail investor community. Traditionally, these individual investors have been seen as insignificant players in the market, lacking the financial resources and expertise to make a significant impact. However, the rise of online communities like Reddit’s WallStreetBets has allowed these retail investors to come together, pooling their knowledge and resources to challenge the established order.

The GameStop and AMC stock events have highlighted a power shift in the market, as individual investors have leveraged the internet to create a force to be reckoned with. The institutions, who were used to having the upper hand, now find themselves scrambling to adapt to this new reality. They must now consider the collective power of retail investors and the influence of social media platforms when making their investment decisions.

Short squeeze and its effects

A key tactic that the retail investors used to drive up the stock prices of companies like GameStop and AMC was a short squeeze. Short selling is a strategy used by investors to profit from a decline in stock prices. In a short squeeze, these short sellers are forced to buy back the shares they borrowed at a higher price, in order to cover their positions, leading to a further increase in the stock price.

When the retail investors on Reddit identified that institutions had taken significant short positions in these struggling companies, they saw an opportunity to rally behind these stocks. They began buying up shares, driving up the prices and forcing the institutions to cover their short positions. The short squeeze created a feedback loop, with higher stock prices attracting more retail investors and fueling further price increases.

The effects of the short squeeze were felt not only by the institutions but also by the broader market. As the stock prices of GameStop and AMC skyrocketed, it created a frenzy among retail investors, many of whom were drawn to these stocks solely for the potential to make quick profits. This speculative buying further drove up the prices, leading to concerns about market stability and the potential for a bubble.

Regulatory scrutiny and legal implications

The GameStop and AMC stock events have not only raised eyebrows but also triggered regulatory scrutiny and legal implications. Regulators are now closely examining the actions of both the retail investors and the institutions involved. There are concerns that the coordinated buying on social media platforms may involve market manipulation or insider trading.

This scrutiny has sparked a broader debate about the role of regulations in the age of social media investing. Some argue that the actions of the retail investors on platforms like Reddit are simply a form of free speech and expression, while others believe that more stringent regulations are necessary to prevent market manipulation and protect investors.

From a legal standpoint, there are also questions surrounding the practices of certain institutions. Some have accused these institutions of engaging in predatory short-selling practices or manipulating the market to their advantage. The legal implications of these allegations are still unfolding, with investigations underway and potential legal actions being considered.

In conclusion, the GameStop and AMC stock events have served as a wake-up call for Wall Street institutions. They have highlighted the power of retail investors and the influence of social media platforms in shaping market dynamics. The short squeeze tactics employed by the retail investors have led to significant financial losses for institutions, as well as broader implications for market stability. As regulators and legal authorities scrutinize these events, the future of investing and regulations in an increasingly digital age remains uncertain.

To make this content most relevant to the keyword ‘amc stock reddit’, it is important to mention how the retail investors on platforms like Reddit’s WallStreetBets played a significant role in driving up the stock price of AMC through their collective buying and coordinated efforts. The surge in AMC stock prices gained significant attention and traction on Reddit, making it a central focus of the retail investor community. This involvement of Reddit in the AMC stock events showcases the power of social media platforms in shaping market movements and influencing investor behavior.

Community building goes beyond monetary investments. It is about fostering connections, creating a sense of belonging, and supporting one another. In the world of finance, this concept has gained significance through the formation of various movements that aim to bring people together. One such movement that has gained immense popularity is the “APE” movement.

Formation of the “APE” Movement

The “APE” movement, which stands for “Amc stock reddit”, originated from an online community of passionate individuals who shared a common interest in investing in AMC Entertainment Holdings, Inc. The movement gained momentum as members banded together, united by their belief in the company’s potential and their desire to influence its future.

This movement, propelled by the power of social media and online forums like Reddit, galvanized investors to join forces and take a collective stand. The platform provided an avenue for individuals to share information, strategies, and insights about AMC stock, thereby empowering members to make informed investment decisions.

Engagement in Charitable Activities

Beyond their investment goals, the “APE” movement has demonstrated a commitment to philanthropy and community engagement. By leveraging their collective strength, members of the movement have engaged in various charitable activities, supporting causes that align with their values and beliefs. This commitment to giving back highlights the movement’s focus on more than just financial gains.

Through organizing fundraisers, charity events, and donations, the “APE” movement has shown that their impact goes beyond the realm of investments. By coming together for a common cause, they have demonstrated the potential of a unified community working towards a greater good.

Creating a Sense of Camaraderie and Support

One of the most significant outcomes of the “APE” movement is the creation of a strong sense of camaraderie and support among its members. Through online discussions and meetups, this community has fostered an environment where individuals can connect, share experiences, and support one another through both successes and challenges.

The “APE” movement has provided a platform for those who may have felt isolated in their investment journey. By joining this community, individuals have found encouragement, guidance, and a space to voice their thoughts and concerns. This collective support system has been crucial in navigating the volatile world of investing and has given members the confidence to stay committed to their goals.

In conclusion, community building goes beyond financial investments. The “APE” movement, formed around the idea of investing in AMC stock, has showcased the power of a united community. Through engagement in charitable activities and the creation of a supportive environment, they have transcended the realms of finance. This movement serves as a testament to the significance of fostering connections and building communities that provide a sense of camaraderie and support. So, if you’re looking for a community that goes beyond investments, the “APE” movement is making a compelling case for its relevance in today’s financial landscape.

Sustainability of AMC’s surge

The recent surge in AMC stock witnessed on the stock market has been a topic of discussion and intrigue. Many wonder if this surge is sustainable and if AMC can continue to maintain its newfound momentum. The rise of AMC’s stock can largely be attributed to the Reddit phenomenon, where a community of individual traders collaborated to modify the stock market’s dynamics. However, it’s crucial to examine the factors that contribute to the stock’s sustainability.

One factor that could potentially impact the sustainability of AMC’s surge is the overall financial health of the company. AMC Entertainment Holdings, Inc., the parent company of AMC Entertainment, operates in the entertainment industry, which experienced a significant downturn during the COVID-19 pandemic due to widespread closures of movie theaters. This resulted in a decrease in revenues and financial hardships for AMC.

The reopening of movie theaters and the return of audiences will play a key role in determining the future of AMC’s stock. As vaccination rates increase and restrictions are lifted, the demand for entertainment experiences like going to the movies is expected to rebound. However, it’s essential to assess whether this demand will be sustained in the long term, especially as streaming platforms gain popularity and consumer preferences continue to evolve.

Another factor that affects the sustainability of AMC’s surge is the ongoing involvement of the Reddit community. The community’s ability to organize and coordinate their actions has been a key driver behind AMC’s recent surge. However, it’s important to note that the Reddit phenomenon is not exclusive to AMC stock. Other stocks, such as GameStop, have also experienced similar surges due to the influence of Reddit traders.

The sustainability of AMC’s surge will depend on the continued participation and coordination within the Reddit community. The ability to maintain a collective interest and support for AMC stock could significantly impact its long-term performance. However, it’s crucial to recognize that market dynamics can change rapidly, and the Reddit community’s focused attention may shift to other stocks or opportunities in the future.

The Reddit community’s involvement in the stock market has taught us several valuable lessons. First and foremost, it has demonstrated the power and influence of individual retail traders. Historically, retail traders have been perceived as having less impact compared to institutional investors. However, the Reddit phenomenon has challenged this notion.

The collective action of the Reddit community has shown that retail traders can influence stock prices and disrupt traditional market dynamics. Their ability to communicate, share information, and coordinate their actions has proven to be a formidable force in the stock market landscape. This phenomenon has demonstrated the strength of the retail investor base and the importance of considering their voices and actions when analyzing market trends.

Another lesson learned from the Reddit community is the significance of social media platforms in shaping investment strategies. The Reddit community predominantly uses platforms like Reddit and Twitter to share insights, discuss investment ideas, and coordinate trading activities. This highlights the increasing importance of social media as a tool for information dissemination and collective decision-making in the financial markets.

Additionally, the Reddit phenomenon has shed light on the potential risks associated with speculative trading. The surge in AMC stock, driven by the Reddit community, has drawn attention to the speculative nature of certain market activities. It serves as a reminder that investment decisions should be based on thorough research, analysis, and an understanding of the inherent risks involved.

Potential impact on the stock market landscape

The Reddit phenomenon and the surge in AMC stock have the potential to shape the stock market landscape in several ways. One possible impact is increased scrutiny and regulation from regulatory bodies. The sudden volatility and price fluctuations witnessed in stocks like AMC have raised concerns among regulatory authorities regarding market manipulation and investor protection. This scrutiny could lead to changes in regulations and policies aimed at mitigating potential risks associated with similar episodes in the future.

Furthermore, the involvement of individual retail traders through platforms like Reddit may inspire a new wave of retail investor participation in the stock market. The success stories shared within the Reddit community could encourage more individuals to actively trade and invest in stocks, leading to increased retail investor engagement. This increased participation could reshape market dynamics and challenge the dominance of institutional investors.

Additionally, the Reddit phenomenon might also impact the traditional role of financial analysts and institutional investors in shaping stock market sentiment. The collective action of the Reddit community has demonstrated the power of online communities in driving market sentiment and price movements. This could potentially influence how investment decisions are made and create new opportunities for alternative sources of market analysis and sentiment evaluation.

In conclusion, the future of AMC stock and the Reddit phenomenon remains uncertain. The sustainability of AMC’s surge will depend on various factors, including the company’s financial health, the participation of the Reddit community, and evolving market dynamics. Lessons learned from the Reddit community emphasize the influence of individual retail traders, the significance of social media platforms, and the risks associated with speculative trading. The impact on the stock market landscape could range from increased regulation to a shift in investor participation and market sentiment evaluation. It’s essential to closely monitor these developments and understand the potential implications for the broader stock market environment. With this understanding, investors can make informed decisions regarding their engagement with AMC stock, the Reddit phenomenon, and the evolving stock market landscape.

In conclusion, the Reddit community has played a significant role in driving the volatile trading activity surrounding AMC stock. The discussions and collective actions on platforms like r/WallStreetBets have demonstrated the power of online communities in influencing the stock market. AMC stock’s Reddit-fueled surge and the resulting market dynamics have captivated investors and analysts alike. It signifies a new era where internet forums and social media platforms can impact traditional financial markets. As investors continue to monitor the influence of Reddit and platforms like it, it becomes clear that the intersection of online communities and stock trading is an evolving landscape.

Trend –